geothermal tax credit canada

In Ontario several different groups including Enbridge Gas Distribution Hydro One Independent Electricity System Operator Ontario. The Green Energy Equipment Tax Credit has been expanded to include biomass fuel energy equipment that is installed in Manitoba and used in a business.

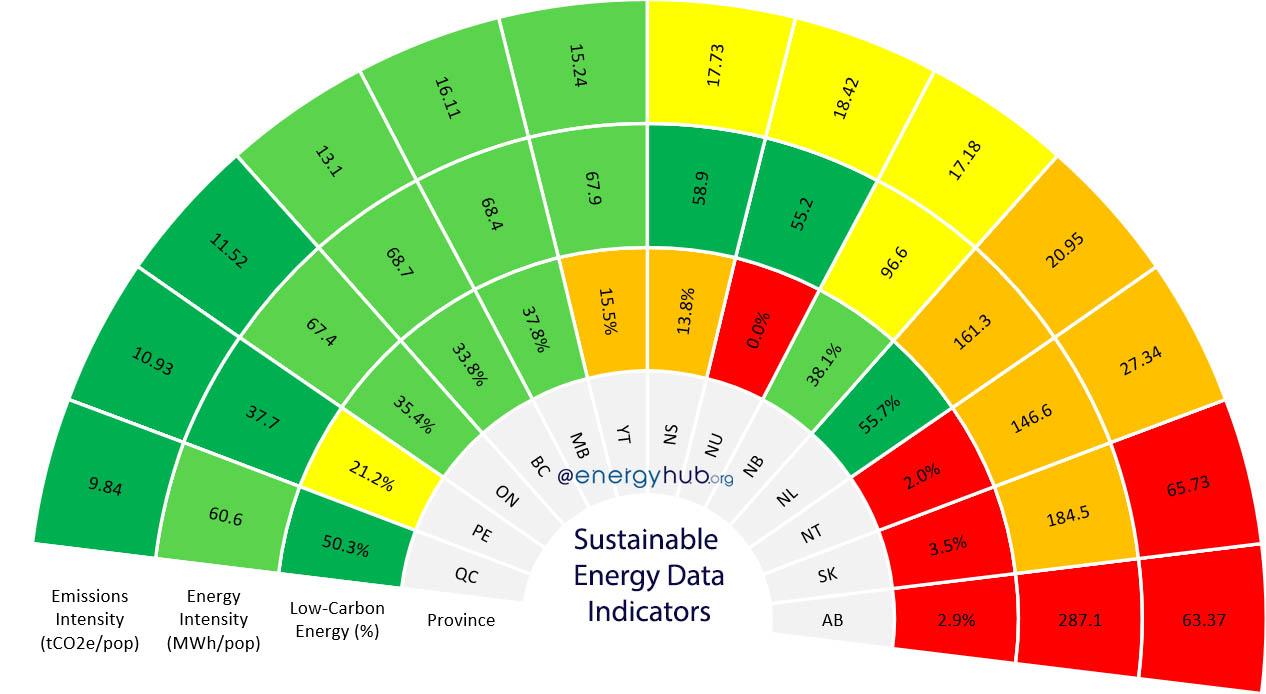

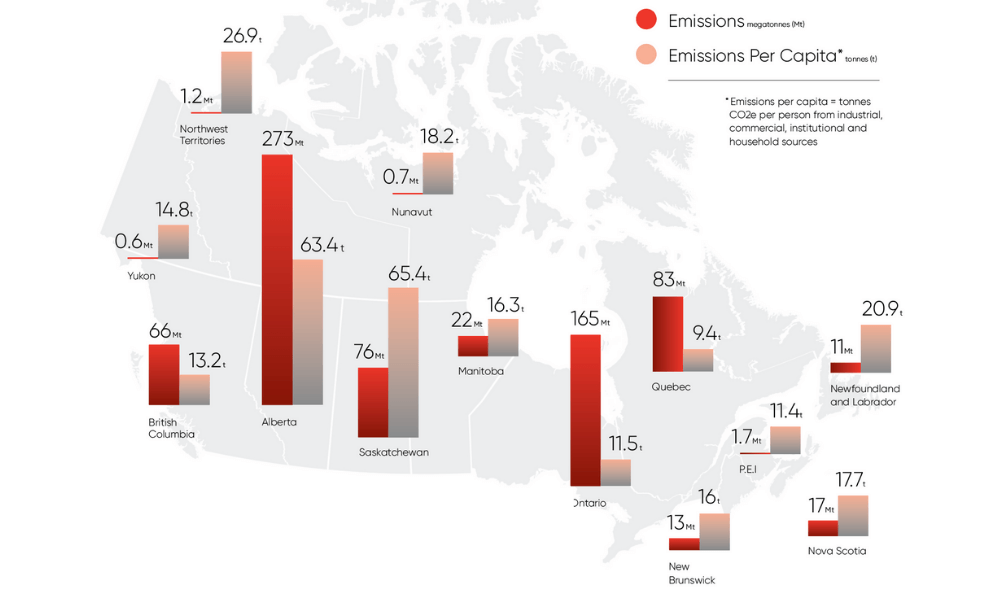

Sustainable Energy Indicators Canada 2021

This tax credit allows you to deduct 26 percent of the cost of installation from your federal taxes.

. Green Energy Equipment Tax Credit. The tax credit rate is 15. Ad Contact Us To Find Out How Your Business Can Take Advantage Of Tax Credit Incentives.

The federal government has invested over 200 million to help people afford products that are energy-efficient otherwise known as ENERGY STAR certified. Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file. The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits.

You can claim this credit if you manufacture and sell geothermal heat pumps for use in Manitoba before July 1 2023. The Federal Investment Tax Credit applies to both solar and geothermal. As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US.

This Tax credit was available through the end of 2016. Get Special Innovation Funds Find Canadas Tax Credits To Help Your Business Thrive. There is a US federal tax credit for residential geothermal heat pump installations equal to 26 of the total system cost.

In 2019 the tax credit was renewed. Geothermal is officially designated as a renewable energy by Natural Resources Canada NRCan. And theres a 10.

Below is an overview of the federal and provincial programs available across Canada. Ad Contact Us To Find Out How Your Business Can Take Advantage Of Tax Credit Incentives. The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings.

Homeowners who install geothermal can get the tax credit. From now through December 31 2022 a federal tax credit for residential. Efficiency Nova Scotia currently has a number of heating system rebates available to Nova Scotians and they include.

Get Special Innovation Funds Find Canadas Tax Credits To Help Your Business Thrive. Geothermal Canada is a not-for-profit organization committed to advancing science and promoting geothermal research and development in Canada. The LLC owners are in a 40.

A grouping of incentives related to energy efficiency from provincialterritorial governments major Canadian municipalities and major electric and gas utilities are offered below. Manufacturers can claim a 75 tax credit on. Complete list of clean energy rebates and incentives in Canada.

Federal Budget 2021 proposed a number of measures to facilitate Canadas economic recovery and to promote the manufacture and use of clean energy equipment. A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022. In December 2020 the tax credit for geothermal heat.

Financial Incentives for Geothermal Heat Pumps. 150 to 2500 for ductless mini-split geothermal. Earth energy technology is preferred because it is an environmentally and socially responsible.

Free for Geothermal Canada members see member email for promocode. Ontario Rebates and Incentives. The tax credit decreases to 26 in 2020 and 22 in 2021.

Manitoba residents who install a new geothermal or solar heating system can. 100000 10000 2 95000. In July a bill was introduced to the.

The incentive will be lowered to 22 for systems that are installed. In a massive environmentally-focused year-end bill congress announced on December 21 2020 that they would extend its federal tax credit for residential ground source. The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT.

And if it exceeds 86 you will receive. The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023. If the federal tax credit exceeds tax liability the excess.

Includes 78 clean energy rebates grants tax credits and forgivable loans. The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009.

Government Of Canada Energy Rebates 2021

Government Of Canada Energy Rebates 2021

Committee Report No 27 Fina 42 1 House Of Commons Of Canada

Net Zero Readiness Index Canada Kpmg Global

Government Of Canada Energy Rebates 2021

Incentives Grants Geosmart Energy

Heat Pump Rebates In Various Canadian Provinces

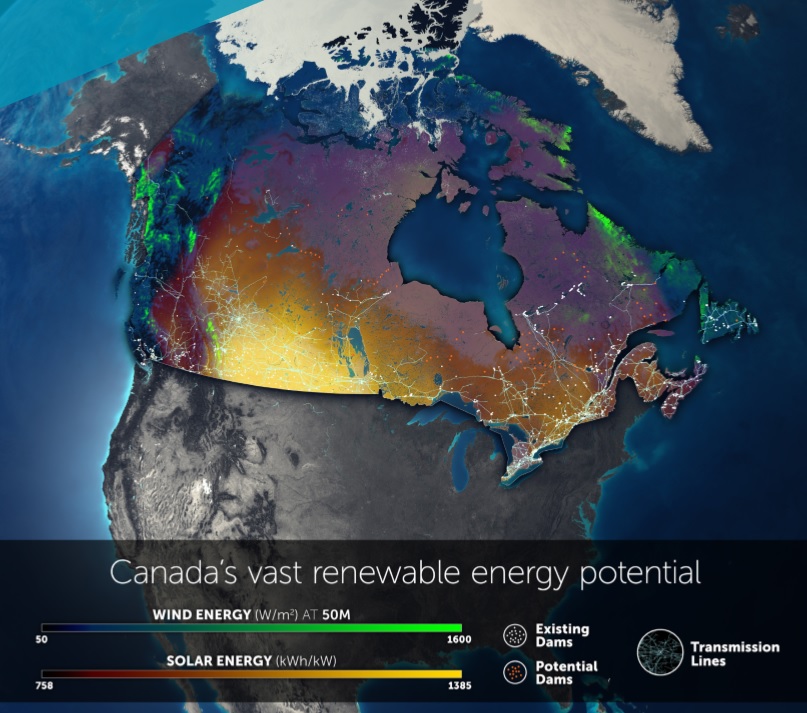

Here S How Canada Could Have 100 Renewable Electricity By 2035 The Narwhal

2022 Government Heating Cooling System Rebates Furnaceprices Ca

Canada Greener Homes Grant How It Works And Who Can Apply Energyrates Ca

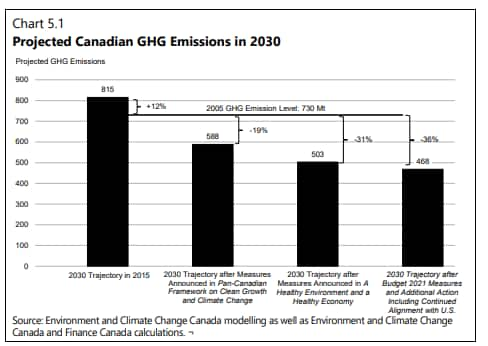

Canada S Fy2021 22 Budget Includes Big Green Investments Indication Of Additional Ghg Emissions Cuts Ihs Markit

Taking On An Audacious National Retrofit Mission Would Enable Canada To Upgrade Every Build Heat Pump Installation Renewable Energy Resources Energy Retrofit

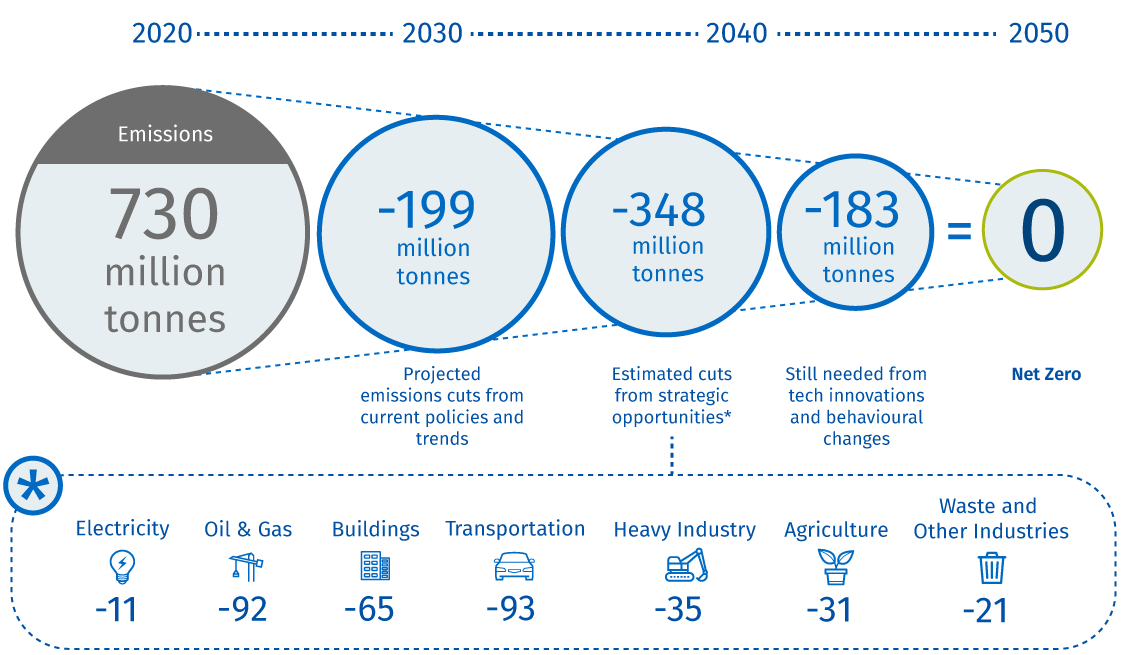

The 2 Trillion Transition Canada S Road To Net Zero

7 Best Canadian Renewable Energy Stocks For Green Investors 2022

![]()

Home Renovation Tax Credits In Canada 2022 Loans Canada

Sustainable Energy Indicators Canada 2021

Canada Greener Homes Grants Program 2022 Step By Step Guide

Energy Wise Canada Building A Culture Of Energy Conservation Business Council Of Canada

Net Zero Report Card How Future Friendly Are Canadian Provinces Corporate Knights